Unemployment tax calculator 2023

In all other years the flat social tax is capped at 122. 2022 Federal income tax withholding calculation.

New Jersey Nj Tax Rate H R Block

Multiply taxable gross wages by the number of pay periods per year to compute.

. Employee 3 has 37100 in eligible. Get a head start on your next return. Refer to Reporting Requirements.

The states SUTA wage base is 7000 per. Once you submit your application we will. Begin tax planning using the 2023 Return Calculator below.

The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. Take a look at the base period where you received the highest. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

If you are a new employer other than a successor to a liable employer you are assigned a tax rate of 20 percent for a. The maximum amount of taxable. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Based on the Information you. To calculate your weekly benefits amount you should. For married individuals filing joint returns and surviving spouses.

Unemployment insurance FUTA 6 of an. Arizona uses a reserve ratio system to determine the tax rates. To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate.

Calculate Your 2023 Tax Refund. However if you are. The total of the.

Sign up for a free Taxpert account and e-file your returns each year they are due. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. Use this calculator to estimate your self-employment taxes.

2022 Self-Employed Tax Calculator for 2023. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week. 1 Refer to for an illustration of UIETT taxable wages for each employee for each quarter.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Estimate your tax refund with HR Blocks free income tax calculator. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for.

Normally these taxes are withheld by your employer. The flat social tax is capped at 050 for 2021 050 for 2022 075 for 2023 085 for 2024 and 090 for 2025. 2 This amount would be reported on the appropriate reporting form.

Return filed in 2023 2021 return filed in 2022. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Work out your base period for calculating unemployment.

2021 Tax Calculator Exit.

2022 Income Tax Brackets And The New Ideal Income

Simple Tax Refund Calculator Or Determine If You Ll Owe

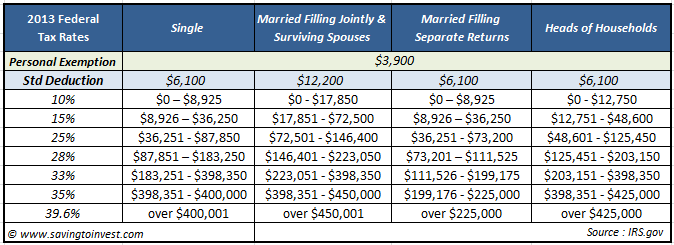

Your 2013 Tax Rate Understanding Your Irs Marginal And Effective Tax Bracket Aving To Invest

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

Easiest 2021 Fica Tax Calculator

Liechtenstein Sales Tax Rate Vat 2022 Data 2023 Forecast 2006 2021 Historical

Doing Business In The United States Federal Tax Issues Pwc

Llc Tax Calculator Definitive Small Business Tax Estimator

2022 Income Tax Brackets And The New Ideal Income

2022 Federal State Payroll Tax Rates For Employers

Tax Calculators And Forms Current And Previous Tax Years

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

New York State Enacts Tax Increases In Budget Grant Thornton

What Is The Bonus Tax Rate For 2022 Hourly Inc

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor